Consultation

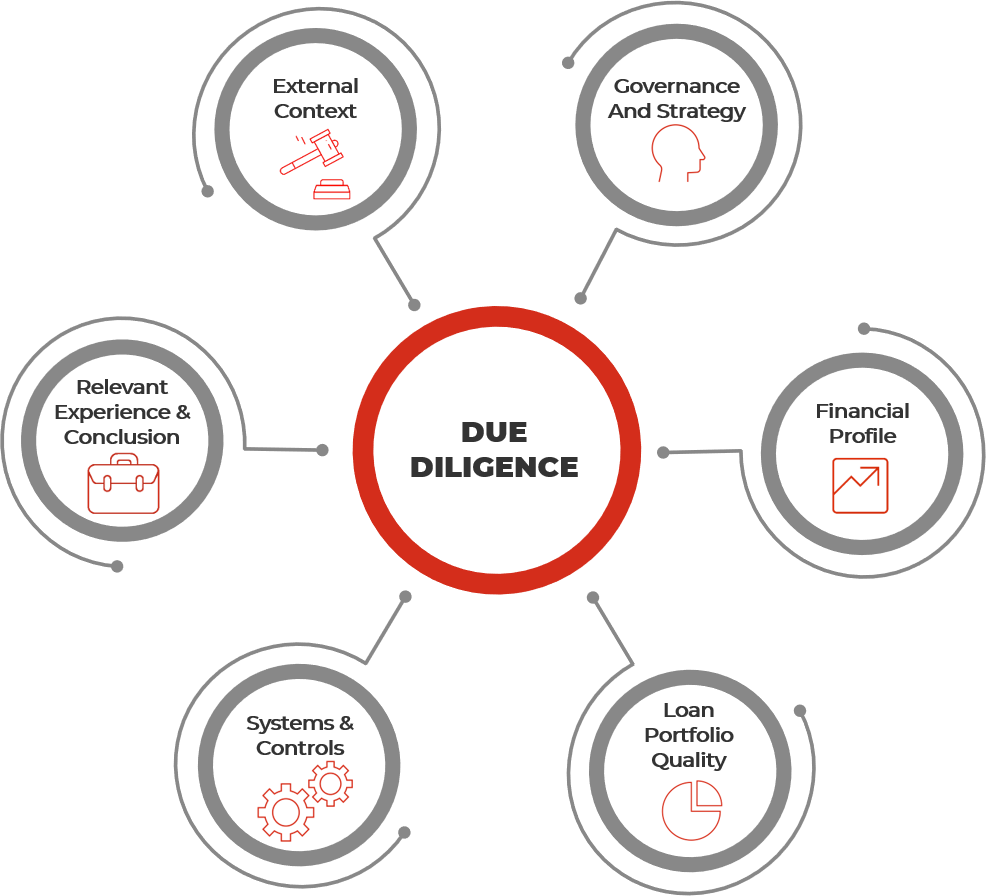

We offer Due Diligence service: legal and financial audit of a company (group of companies, holding, etc.), including, but not limited to:

What you get: A reasoned conclusion based on the results of the audit, existing risks.

In general, due diligence service can be useful for any party who wants to obtain complete and objective information about a company or project before making strategic decisions or transactions.

NRG audit is a member of "Collegium of Auditors" Public Joint-Stock Company (https://auditors.kz/), co-founder of the Union of Tax Consultants Organizations

In general, due diligence is an important stage of any transaction or investment, as it allows you to assess the risks, value and potential of the business, as well as improve transparency and trust between the parties to the transaction.

Due diligence should be entrusted to professional consultants or audit firms specializing in this area. We have the experience and knowledge to thoroughly review and analyze all aspects of a business or transaction, including financials, legal aspects, operations, company reputation and other factors.

Leave your phone number and we will call you back soon

Accounting services and audit in Astana

Contact us directly during working hours and we will advise you on what you are interested in, or you can leave a request and we will call you back